The role that Investor Relations PR plays in fostering trust and confidence between financial institutions, investors and stakeholders cannot be understated.

Effective investor relations strategies enhance transparency and also ensure that financial communications are clear, accurate, and timely.

As the global PR market is projected to grow to US$133 billion by 2027, the importance of IR PR continues to rise, driven by increasing demands for transparency and accountability in financial services and fintech sectors.

The Role of Investor Relations in Enhancing Transparency and Trust

Transparency is a cornerstone of trust in the financial markets. Investor relations public relations agencies play a crucial role in bridging the gap between companies and their stakeholders by providing clear, consistent, and accurate information.

As we approach the end of 2024, the landscape of financial transparency is evolving rapidly. Recent legislative changes and reports underscore this shift:

– Financial Data Transparency Act of 2022: This US regulation mandates that financial data be presented in a more accessible and standardised format.

– 2023 Fiscal Transparency Report: According to the US State Department, only 72 out of 141 surveyed countries meet basic fiscal transparency criteria.

To foster transparency and trust, effective IR PR strategies focus on several key practices. Regular updates on financial performance, strategic initiatives, and market conditions are crucial for keeping investors informed.

Detailed reporting ensures that financial reports and disclosures are comprehensive and easy to understand. Additionally, maintaining open communication channels with investors allows for addressing concerns and providing valuable insights.

These practices collectively build investor confidence by demonstrating a strong commitment to openness and accountability.

The term “transparent” has become integral to financial reporting, signifying clarity and straightforwardness. For example, consider two companies with identical market capitalization, risk exposure, earnings, and returns. Company X, with simple and understandable financial statements, is likely to be valued more highly than Company Y, which has complex financials due to its multiple subsidiaries.

The disparity in valuation arises from the uncertainty that complex and opaque financial statements create. Investors prefer companies with clear and transparent financial reporting, as it reduces uncertainty about a company’s fundamentals and risk.

For instance, it is challenging to evaluate a company’s investment performance or debt levels when financial information is obscured by complex structures or hidden through holding companies. High-profile cases like Enron and Tyco have highlighted how a lack of transparency can lead to severe financial repercussions and erode investor trust.

How Financial PR Agencies Build Investor Confidence

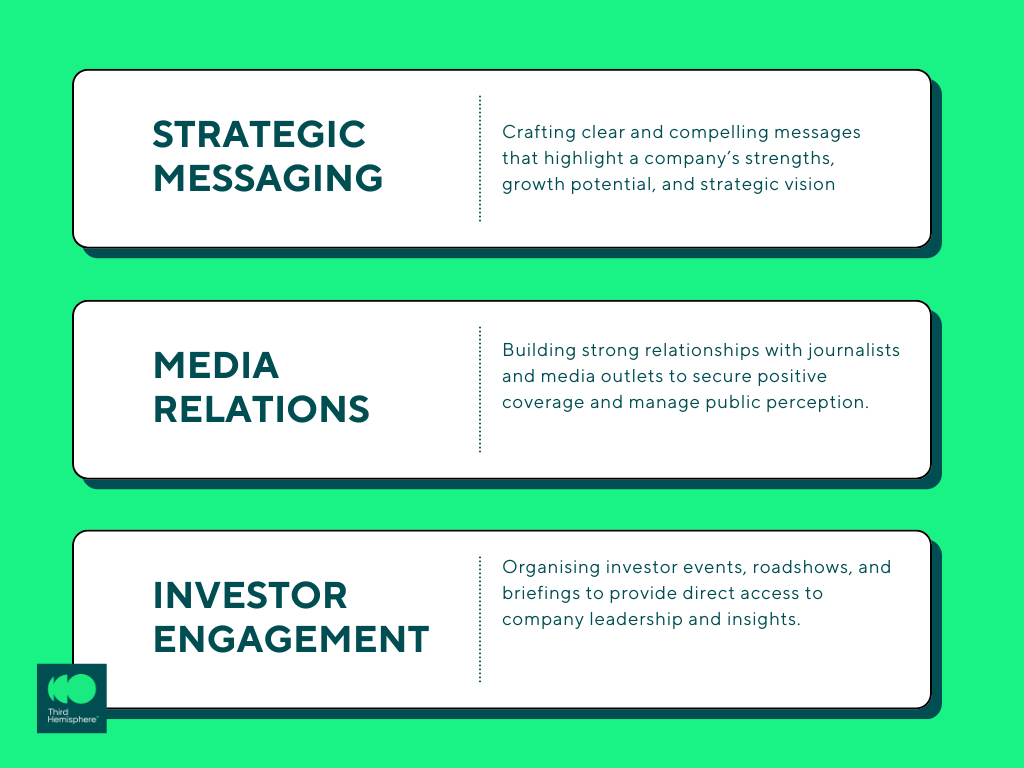

Financial PR agencies play a crucial role in shaping the narrative around a company’s financial health and strategic direction. They achieve this through:

A LinkedIn study found that 55% of decision-makers in the financial sector use thought leadership, a key public relations tactic, to evaluate organizations they might engage with. This aligns with insights from Axios, which reveal a direct correlation between CEO visibility and overall corporate visibility, significantly impacting business outcomes.

These findings underscore the growing importance of media engagement—both social and earned—in meeting buyer expectations and benefiting stakeholders, including vendors, employees, and clients.

By implementing these strategies, financial PR agencies help companies present a strong and credible image to the investment community.

Utilising Technology for Clear Communication and Real-Time Reporting

Technology has revolutionised the way investor relations PR operates. Tools and platforms that enhance communication and reporting include:

– Investor Portals: Secure online platforms that provide investors with real-time access to financial reports, updates, and company news.

– Data Analytics: Advanced analytics tools that track market sentiment, investor behaviour, and media coverage to inform PR strategies.

– Digital Communication Channels: Utilising social media, webinars, and virtual events to reach a broader audience and engage with investors in real-time.

The use of technology in IR PR not only improves the efficiency of communication but also enhances the accuracy and timeliness of reporting.

Crisis Communications: Maintaining Trust During Uncertain Times

Crisis management is a crucial component of investor relations PR, essential for maintaining trust during turbulent periods. Effective crisis communication strategies involve thorough preparedness, transparency, and responsive communication.

Developing comprehensive crisis communication plans allows organizations to address potential issues swiftly and effectively. Providing honest and accurate information during a crisis is vital for preserving trust and credibility.

Additionally, quickly addressing concerns and managing the flow of information helps prevent misinformation and panic. By focusing on these strategies, organizations can navigate crises with confidence and maintain strong stakeholder relationships.

For example, during the 2020 financial market turbulence caused by the COVID-19 pandemic, companies that communicated openly and proactively with investors were better able to maintain trust and confidence.

Case Study: DigitalX – A Practical Example of Effective Investor Relations

The DigitalX case study exemplifies the critical role of investor relations in enhancing transparency and building trust. As the world’s only ASX-listed digital assets fund manager, DigitalX faced the significant challenge of launching the world’s first ASX-listed Bitcoin ETF.

To address this, Third Hemisphere implemented a comprehensive PR and IR strategy that underscores key practices in effective investor relations.

Key Strategies and Outcomes:

– In-Depth Market Research and Tailored Communication: Third Hemisphere conducted thorough market research to identify investment opportunities and crafted clear, compelling investor communications. This approach ensured that stakeholders received accurate and relevant information, enhancing transparency.

– Strategic Media Engagement: The team pitched tailored stories to tier-1 media across Australia, Asia, and international markets, effectively highlighting DigitalX’s unique position in the digital assets sector. This proactive media strategy led to high-profile features and significant recognition, including coverage in Ausbiz, Investor Daily, and Finder.

– Successful Non-Deal Roadshow: Organizing a non-deal roadshow in Singapore allowed DigitalX to engage directly with high-calibre investors and key stakeholders. The positive feedback and ongoing conversations from this event reinforced DigitalX’s leadership position and commitment to transparent communication.

– Impactful Media Coverage: The PR efforts resulted in seven pieces of coverage with a combined online readership of 10.4 million and 43.1K estimated views. This high level of media exposure and social media engagement demonstrated the effectiveness of clear and strategic communication in building investor confidence.

This case study illustrates how robust investor relations practices and transparent communication can significantly impact market perception and investor trust.

By addressing the challenges and leveraging opportunities effectively, DigitalX has reinforced its position as a leader in the digital assets space, serving as a powerful example of the benefits of transparency and strategic IR efforts.

Conclusion

Investor relations PR is vital for building and maintaining trust, confidence, and strong relationships in the financial markets. By enhancing transparency, leveraging technology, managing crises effectively, and navigating regulatory challenges, financial PR agencies play a crucial role in shaping a company’s reputation and investor relations strategy.

As the demand for specialised PR services grows into a $133 billion market, companies like DigitalX demonstrate the tangible benefits of a well-executed IR PR strategy. For more information on how Third Hemisphere can help your organization build trust and enhance investor relations, reach out to us today.