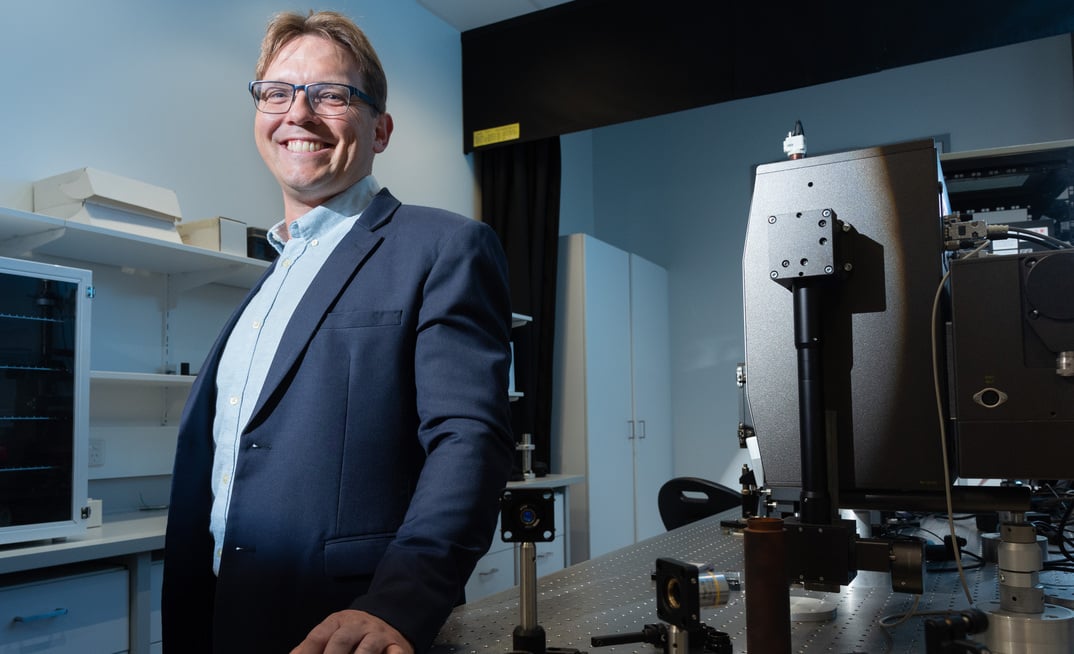

Global private investment firm focused on the smaller end of the middle market The Riverside Company (Riverside) has appointed former Deliveroo, and Meridian Energy CEO Ed McManus as a Senior Operating Partner.

McManus will join the Riverside Australia Fund (RAF) focussing on Australia and New Zealand, where he will manage RAF’s 6-person operating team, expanding its local capabilities including through leveraging Riverside’s 75+ person strong global operating team, and helping to drive revenue and profit growth across the portfolio.

McManus will serve as Senior Operating Partner and chair the board of RAF’s most recent investment, Virtual IT Group.

He will leverage his 18+ years’ of executive experience leading and advising high-growth businesses across industries including health, energy, technology, and consumer goods where he drove revenue growth, profitability, and operational excellence.

This includes four years as Deliveroo Australia and Singapore CEO where he more than doubled revenue, five years as CEO of Powershop Australia where he grew the customer base from under 10,000 to over 180,000, and four years as CEO of Meridian Energy where he spearheaded the expansion of its energy generation portfolio. Most recently, McManus held an interim CEO role at a private equity-backed growth business, leading its expansion into the US.

This experience will add formidable gravitas to the Riverside Australia team following this year’s successful sales of software provider Energy Exemplar, and infrastructure services business HiwayGroup.

Simon Feiglin, Managing Partner at Riverside Company, said: “Ed is a highly accomplished executive with a deep understanding of the Australian market and a proven ability to unlock new value in businesses. His experience across multiple sectors, particularly in growth and expansion, will be invaluable to the team and portfolio companies in which Riverside invests.”

Ed McManus, Senior Operating Partner at Riverside Company, added: “Riverside’s commitment to fuelling transformative growth and creating lasting value, coupled with its impressive portfolio in Australia and New Zealand attracted me to the role.. I look forward to helping founders and CEOs and their exec teams grow their businesses successfully by leveraging my diverse functional and industry experience”

RAF typically works with entrepreneurial founders of high-growth, profitable Australian and New Zealand-based businesses with earnings before interest, taxes, depreciation, and amortisation of up to AUD$25 million who are looking for a partner with global knowledge and experience, where the team believes they can help accelerate growth domestically or internationally.

Since its inception in 2010, RAF has completed over 45 investments seeking to build bigger, more sustainable, and more profitable businesses through organic and add-on strategies.

# # #

The Riverside Company (www.riversidecompany.com) is a global investment firm focused on being one of the leading private equity and flexible capital options for business owners and portfolio company employees at the smaller end of the middle market by seeking to fuel transformative growth and create lasting value. Since its founding in 1988, Riverside has made more than 1,000 investments. The firm’s international private equity and flexible capital portfolios include more than 140 companies. Riverside Australia invests in Australia- and New Zealand-based companies with LTM EBITDA of up to AUD$25 million.